Transmission: The Dollar’s Shadow

Mauritania is a small open economy.

That means its currency is not a background variable — it is a structural force.

This section answers one clear question:

When the Ouguiya moves, do prices follow?

We measure this using exchange rate pass-through (β).

1. What is Pass-Through?

Pass-through measures how much monthly inflation changes when the exchange rate changes.

Formally:

\[ \pi_t = \alpha + \beta \Delta FX_t + \varepsilon_t \]

Where:

- $ _t $ = monthly inflation

- $ FX_t $ = monthly change in USD/MRU

- $ $ = pass-through coefficient

Interpretation:

- β = 0 → FX has no inflation effect

- β > 0 → depreciation raises inflation

- β < 0 → system absorbs shock

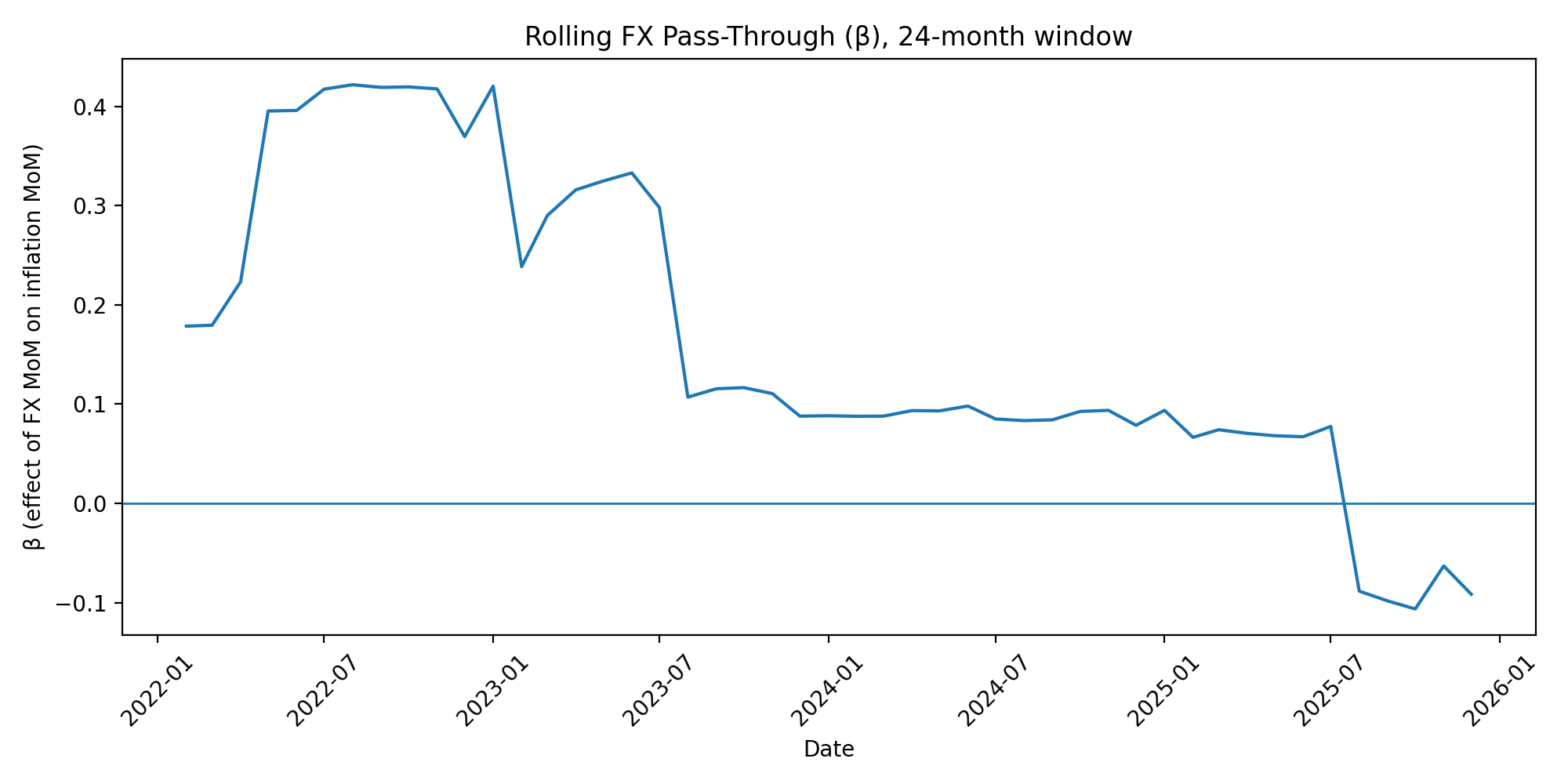

2. Rolling Pass-Through (24-Month Window)

Pass-through is not constant across time.

We estimate β using rolling 24-month regressions.

3. Two Regimes Appear

The data clearly divides into two behavioral systems.

Amplifier Regime (2022–2023)

From your regime table:

- Headline β ≈ 0.12

- Food β significantly higher

- High persistence (see next section)

This means:

A 1% depreciation in the Ouguiya translated into approximately 0.12% monthly inflation.

Shocks did not fade. They transmitted.

This was the commodity spike era. Global food and energy prices surged. Inflation breached the 5.53% structural threshold identified in prior Mauritanian studies.

The system amplified shocks.

Absorber Regime (2024–2025)

From your computed table:

- Headline β ≈ -0.02

- Food β collapsed

- FX shocks no longer mechanically transmitted

This is a structural break.

The Ouguiya still moved. But inflation stopped responding mechanically.

The system absorbed shocks instead of propagating them.

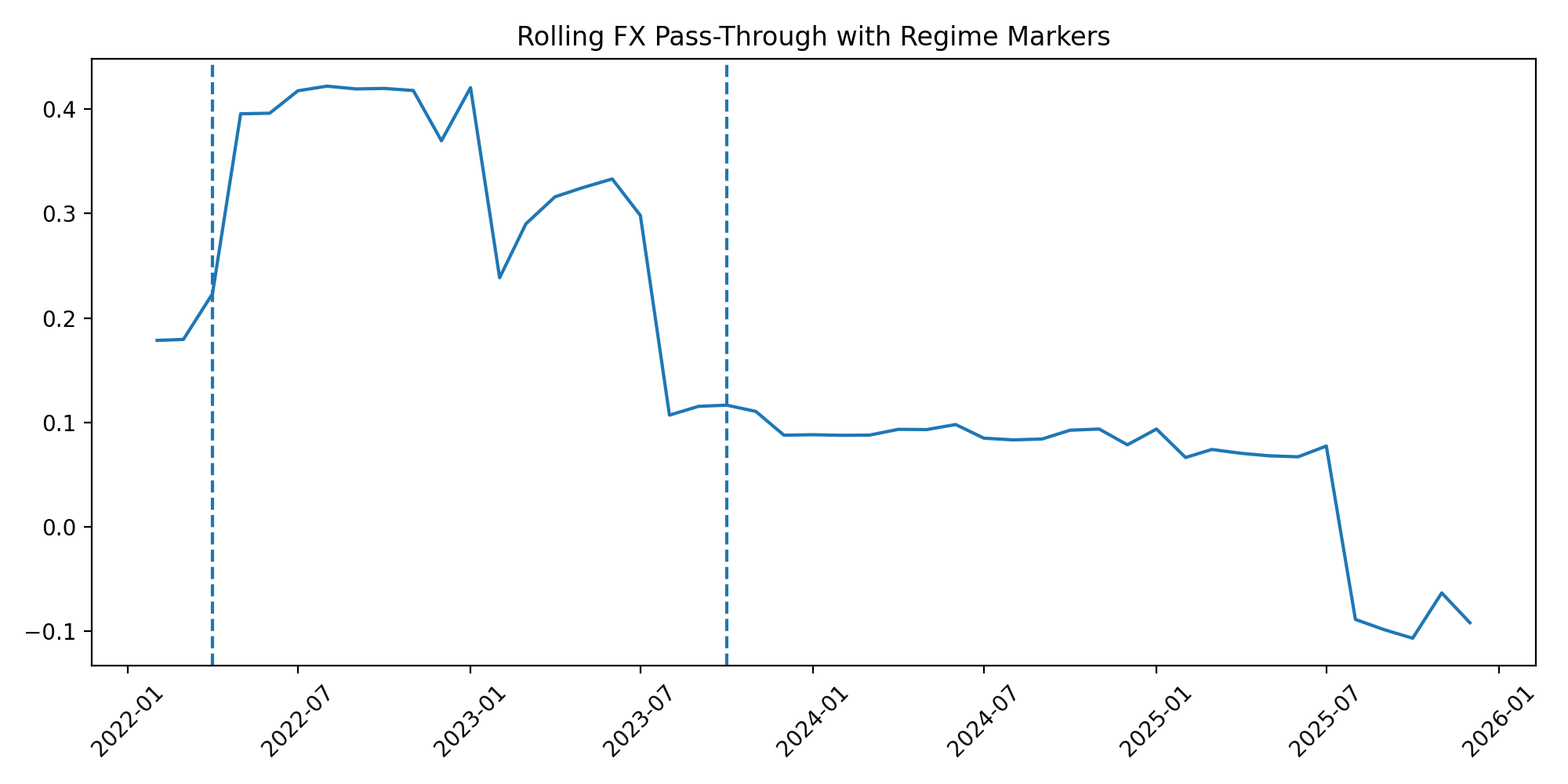

4. Structural Markers Overlay

Below is the same rolling beta with political regime markers:

Vertical markers include:

- March 2020 – COVID shock

- August 2020 – PM Bilal appointment

- February 2024 – AU Chairmanship

- August 2024 – PM Mokhtar Ould Djay appointment

The behavioral break aligns most clearly with the 2023 FX platform transition and consolidates during the 2024 political reset.

5. Interpretation

This is not about low inflation.

It is about elasticity.

Between 2022 and 2023:

- The economy behaved like an amplifier.

- External shocks multiplied internally.

Between 2024 and 2025:

- The economy behaved like a shock absorber.

- External shocks dissipated.

This is the first pillar of the Great Decoupling.

Inflation did not just fall.

Its reaction function changed.