Memory: Does Inflation Forget?

Inflation is not only a level.

It is a process.

Some economies experience temporary price spikes.

Others experience inflation that feeds on itself.

This section asks a simple but decisive question:

After a shock, does inflation fade — or does it echo?

We measure this using inflation persistence (ρ).

1. What Is Inflation Persistence?

We estimate a simple AR(1) process:

\[ \pi_t = \alpha + \rho \pi_{t-1} + \varepsilon_t \]

Where:

- $ _t $ = monthly inflation

- $ $ = persistence coefficient

- $ _t $ = new shock

Interpretation:

- ρ = 0 → inflation has no memory

- ρ between 0 and 0.5 → moderate memory

- ρ above 0.5 → strong inertia

- ρ near 1 → self-reinforcing inflation system

Another way to interpret ρ:

\[ \text{Shock Remaining After k Months} = \rho^k \]

If ρ = 0.6, then after 3 months:

\[ 0.6^3 = 0.216 \]

Meaning 21.6% of the original shock still remains.

Persistence determines whether inflation dies quietly or lingers.

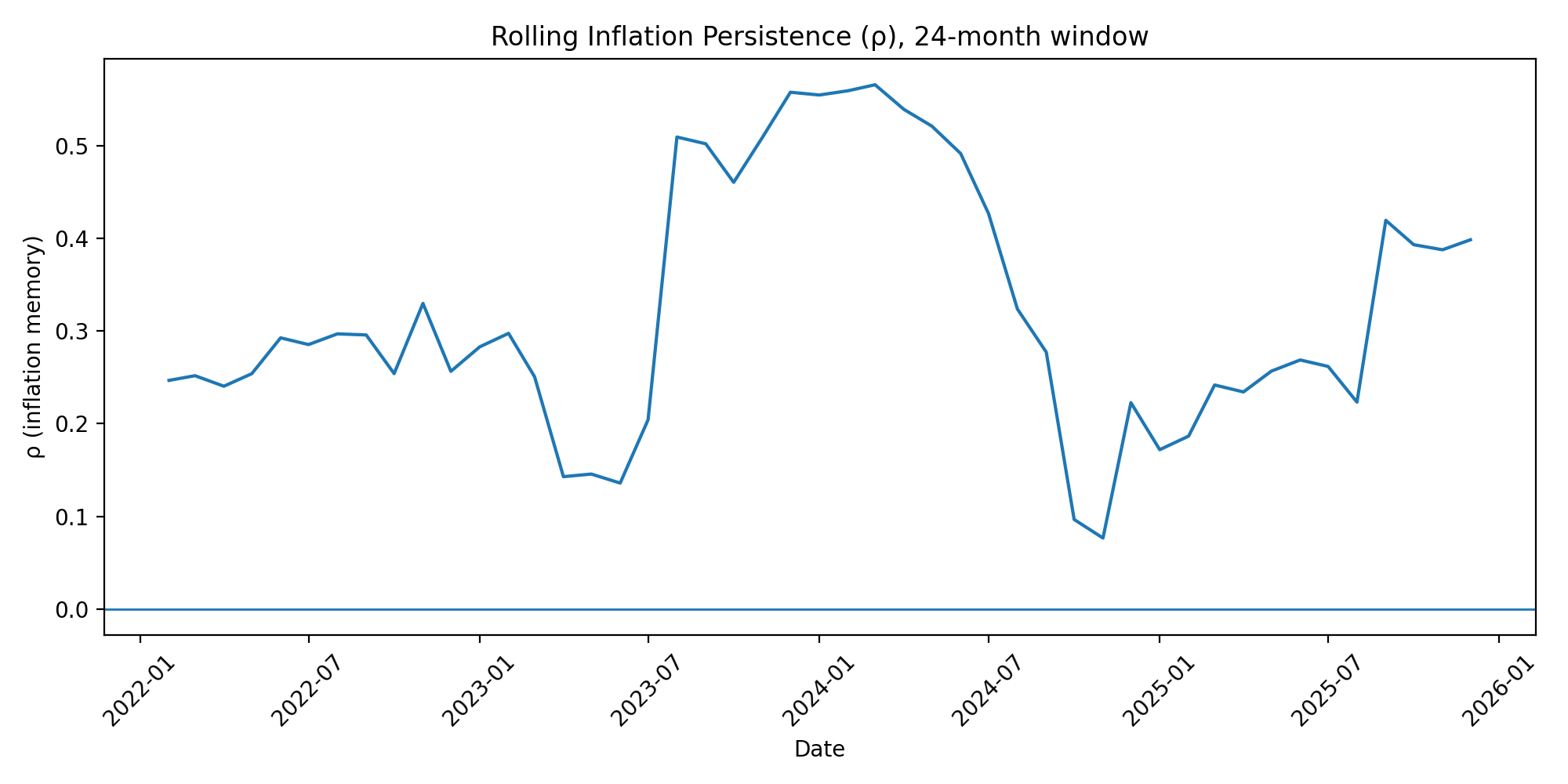

2. Rolling Inflation Memory (24-Month Window)

We estimate rolling 24-month AR(1) coefficients.

3. The Inflation Character Changes

Two regimes emerge again.

Amplifier Phase (2022–2023)

From your regime table:

- Headline ρ ≈ 0.60+

- Food ρ ≈ 0.74

This is high inertia.

Interpretation:

A shock to food prices in 2022 did not disappear next month.

It contaminated future months.

Businesses raised prices not only because of new shocks,

but because inflation was already elevated.

This is behavioral inertia.

Inflation had memory.

Absorber Phase (2024–2025)

From your computed table:

- Headline ρ ≈ 0.30–0.40

- Food ρ ≈ 0.40

Memory weakened dramatically.

Using your full-sample estimate:

- ρ ≈ 0.57

- Half-life ≈ 1.24 months

- ρ³ ≈ 0.188

But inside the absorber regime, persistence drops further.

Shocks decay faster.

The inflation process becomes less self-reinforcing.

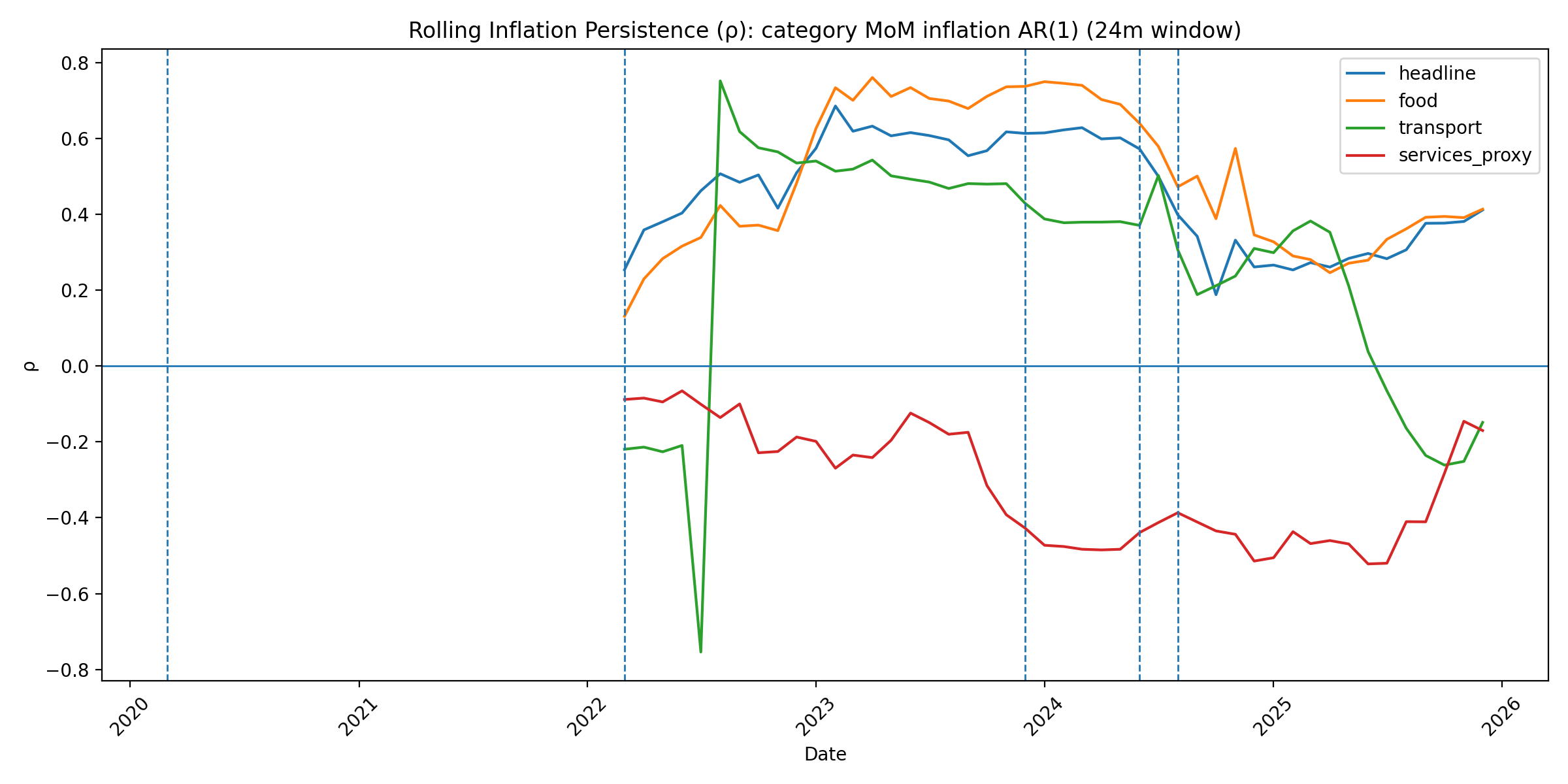

4. Category-Level Inertia

Inflation is not monolithic.

Below is the rolling persistence by category:

Observations:

- Food exhibits the strongest inertia in 2022–2023.

- Transport spikes sharply, then collapses.

- Services proxy behaves differently — sometimes even negative autocorrelation.

This matters.

In small open economies, food and fuel shape expectations.

When food persistence falls, inflation psychology shifts.

5. Why 2022 Was Different

In 2022:

- Global commodity shock

- Inflation exceeded structural 5.53% threshold identified in prior Mauritanian studies

- Businesses began indexing behaviorally

Above that threshold:

Inflation ceases to be mechanical. It becomes adaptive.

The data shows this clearly.

6. The Decay of Memory

By 2024–2025:

- ρ falls

- β falls

- Volatility stabilizes

Inflation stops echoing.

This is the second pillar of the Great Decoupling.

The system no longer multiplies its own shocks.

7. Why This Matters

Low inflation can still be fragile.

But low persistence is structural.

When memory declines:

- Policy transmission improves

- FX shocks fade faster

- Expectations stabilize

- Regime credibility increases

Mauritania did not only lower inflation.

It altered its inflation chemistry.

The next layer:

Was this transformation uniform across the CPI basket?