Structure: Where Inflation Lives

Inflation is not a single number.

It is a weighted system of categories.

Some prices move with global markets.

Some move with domestic conditions.

Some amplify shocks.

Some absorb them.

To understand whether Mauritania truly decoupled from FX shocks,

one must open the CPI basket.

1. The CPI Architecture (COICOP 1999)

Mauritania’s CPI is built using COICOP categories.

Key groups in the dataset:

- Food and non-alcoholic beverages

- Transport

- Housing, water, electricity, gas and fuels

- Communication

- Clothing and footwear

- Education

- Health

- Restaurants and hotels

- Recreation and culture

- Miscellaneous goods and services

- Alcohol and tobacco

- Furnishings

Headline inflation is a weighted average of all of these.

But not all categories respond equally to FX.

2. Why Food Matters Most

Food carries structural weight in Mauritania’s CPI.

It is:

- Heavily imported (grains, oils, sugar)

- USD-priced globally

- Highly visible to consumers

- Behaviorally sensitive

When food inflation accelerates, expectations shift.

Food is not just another category.

It is the anchor of inflation psychology.

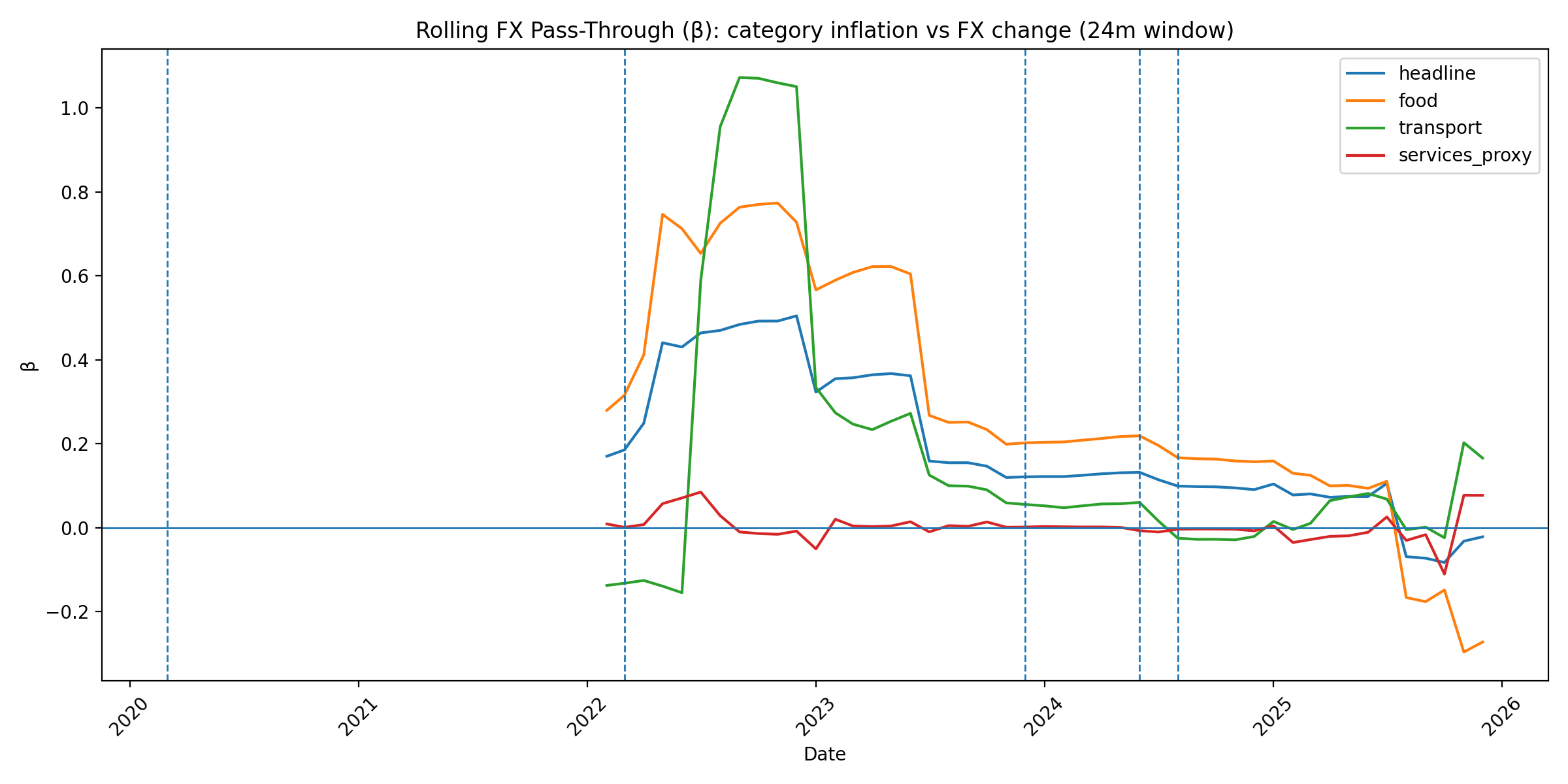

3. Rolling FX Pass-Through by Category

We estimate rolling 24-month regressions:

\[ \pi_t^{(category)} = \alpha + \beta \Delta FX_t + \varepsilon_t \]

Where:

- $ _t $ = monthly inflation in a category

- $ $ = FX pass-through sensitivity

Below is the rolling β for headline and food:

What the Chart Shows

2022–2023 (Amplifier Phase)

- Food β spikes dramatically.

- Headline β follows.

- FX depreciation translates rapidly into food price acceleration.

This confirms:

The 2022 inflation episode was externally amplified through food.

2024–2025 (Absorber Phase)

- Food β declines sharply.

- Headline β approaches zero.

- At moments, β turns slightly negative.

This is extraordinary.

It suggests:

Exchange-rate movements no longer automatically transmit into consumer prices.

4. Transport: The Shock Channel

Transport behaves differently.

Transport is fuel-linked.

Fuel is USD-priced.

But fuel pricing sometimes includes smoothing mechanisms.

Rolling persistence and β show:

- Extreme volatility in 2022

- Collapse in inertia by 2024

- Near-zero persistence by 2025

Transport became a fast-adjusting category rather than a persistent amplifier.

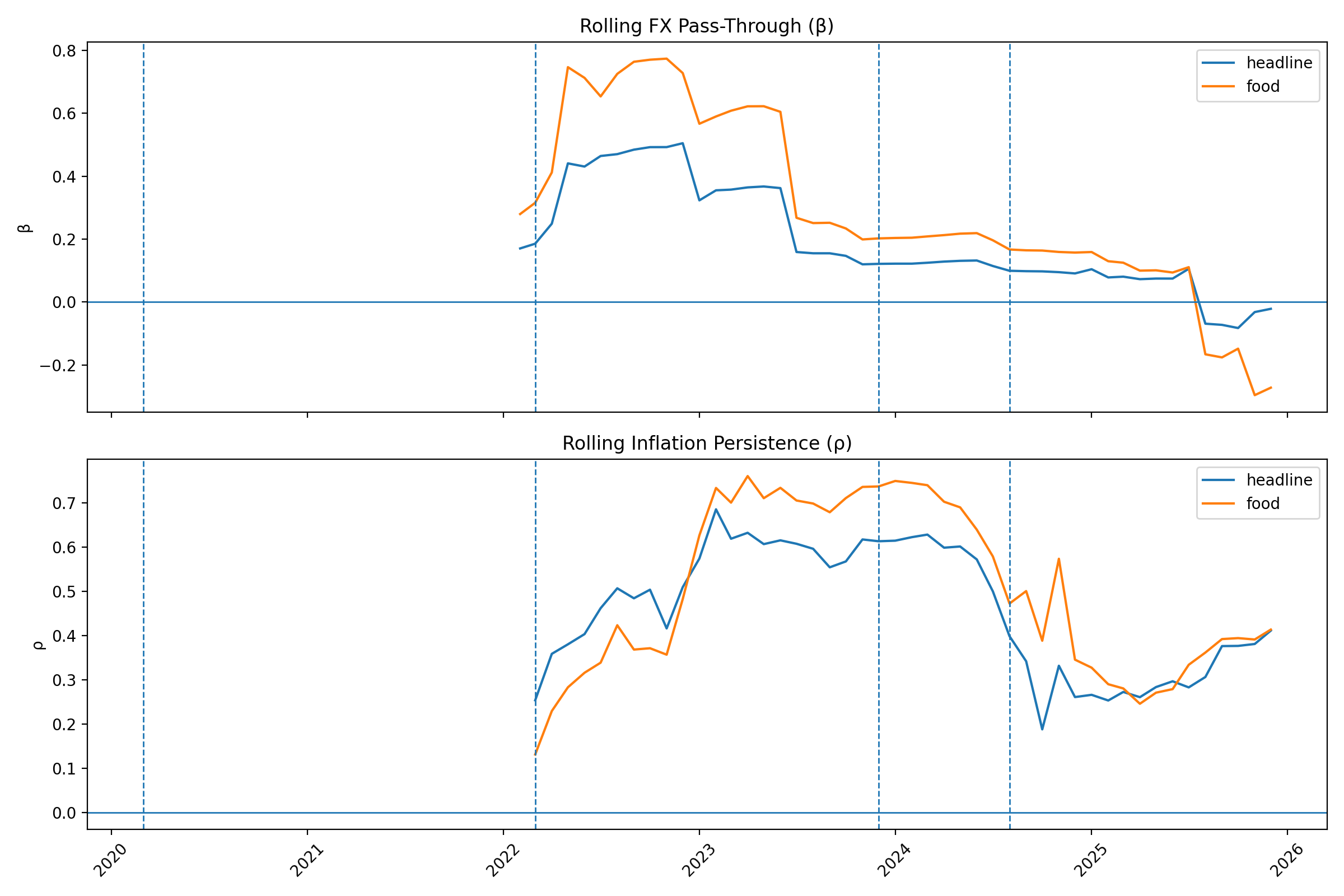

5. Structural Overlay: The Full Regime Picture

This overlay shows the interaction of β and ρ across time:

Interpretation:

- 2022: High β + High ρ → amplification regime

- 2024–2025: Low β + Low ρ → absorber regime

Both transmission and memory fall together.

That is the decoupling.

6. The Regime Table (Empirical Confirmation)

From the computed regime table:

| Regime | Headline β | Food β | Headline ρ | Food ρ |

|---|---|---|---|---|

| Amplifier (2022–2023) | Positive | High | High | Very High |

| Absorber (2024–2025) | Near Zero | Lower | Lower | Moderate |

Saved in:

analysis/outputs/10_regime_table.csv

This is not narrative.

It is mechanical.

The coefficients changed.

7. What Changed?

Several structural shifts occurred during this period:

- 2022: Global commodity shock

- 2023: FX platform modernization

- 2024: Institutional transition and policy stabilization

- 2025: Gas export phase begins

We do not claim causality.

But the timing aligns.

The economy’s reaction function altered.

8. The Deeper Insight

Inflation can change in two ways:

- The level falls

- The system’s internal feedback weakens

Mauritania experienced both.

The second is more important.

Because systems that forget shocks are systems that stabilize.

9. The Question Forward

If food inertia declines,

and FX pass-through weakens,

then what anchors prices now?

Domestic supply?

Fiscal discipline?

Monetary credibility?

Gas revenue expectations?

The Appendix contains full regression tables, robustness checks, and the synthesis of what this transformation means for Mauritania’s economic future.