Mauritania's inflation didn't just fall — it changed behavior.

2020–2025, measured with CPI + USD/MRU FX data.Stability is not low inflation.

Stability is when shocks fade instead of multiplying.

Between February 2020 and December 2025, Mauritania experienced:

- A global pandemic shock

- A historic 2022 food and energy spike

- Institutional transitions at the executive level

- A modernization of the foreign exchange market

- The transition toward gas-exporting status

Inflation did not merely rise and fall during this period.

It changed behavior.

This report studies whether Mauritania’s inflation system shifted from an amplifier of shocks to a shock-absorbing regime.

The Core Question

Did Mauritania’s inflation mechanism structurally change between 2020 and 2025?

More precisely:

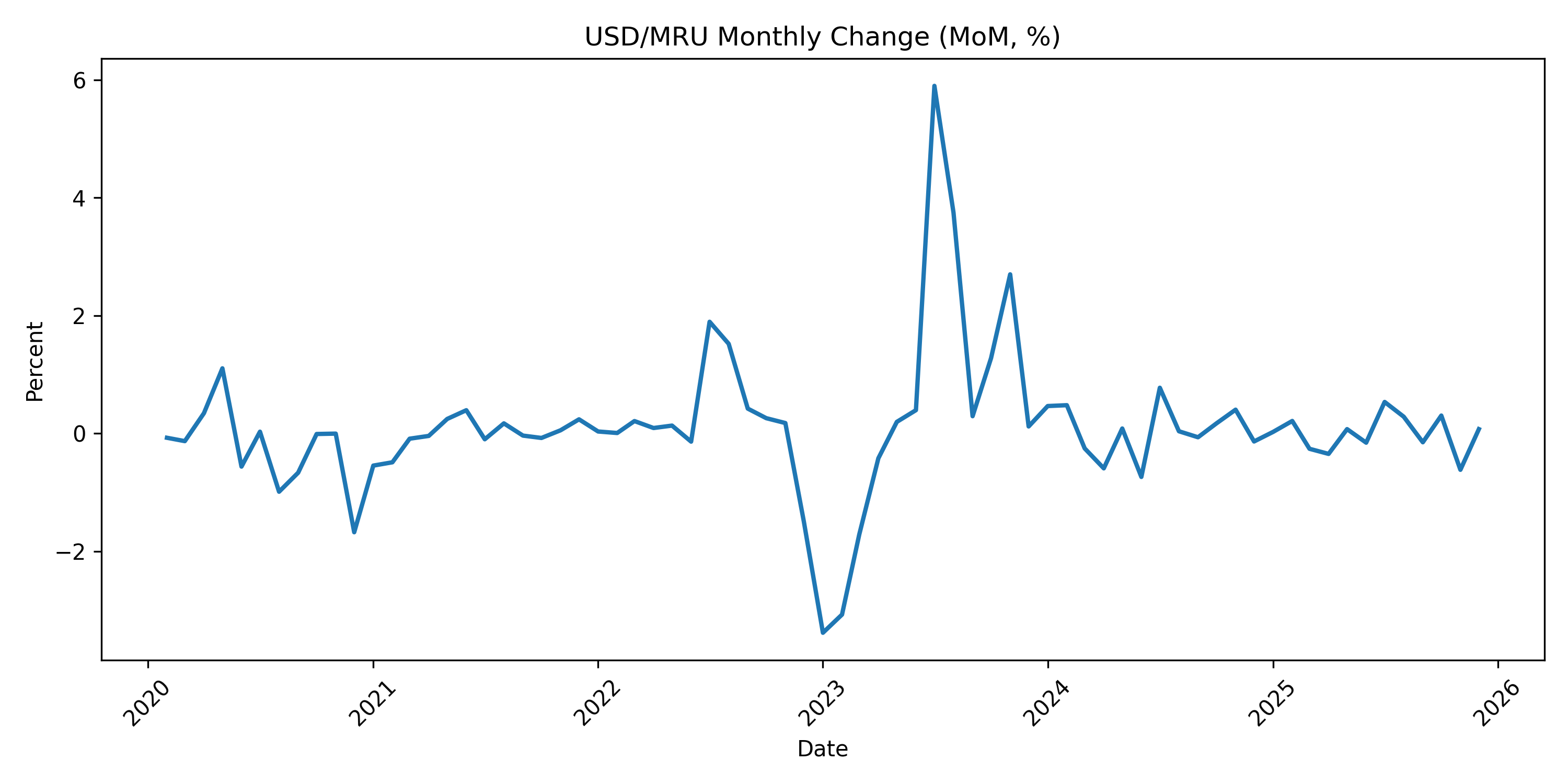

- Does USD/MRU exchange rate movement transmit into inflation?

- With what strength?

- With what delay?

- And did that transmission weaken after institutional and FX market reforms?

We do not speculate.

We measure.

The Data Window

Start date: 2020-02

We begin in February 2020 for disciplined reasons:

- It avoids transitional noise after the 2019 presidential inauguration.

- It captures the full COVID macro shock period.

End date: 2025-12

This includes: - The 2022 inflation spike - The 2023 FX platform modernization - The August 2024 Prime Minister transition - The first gas export period

The window is intentional. It is clean. It is reproducible.

What We Measure

We analyze three core behavioral parameters:

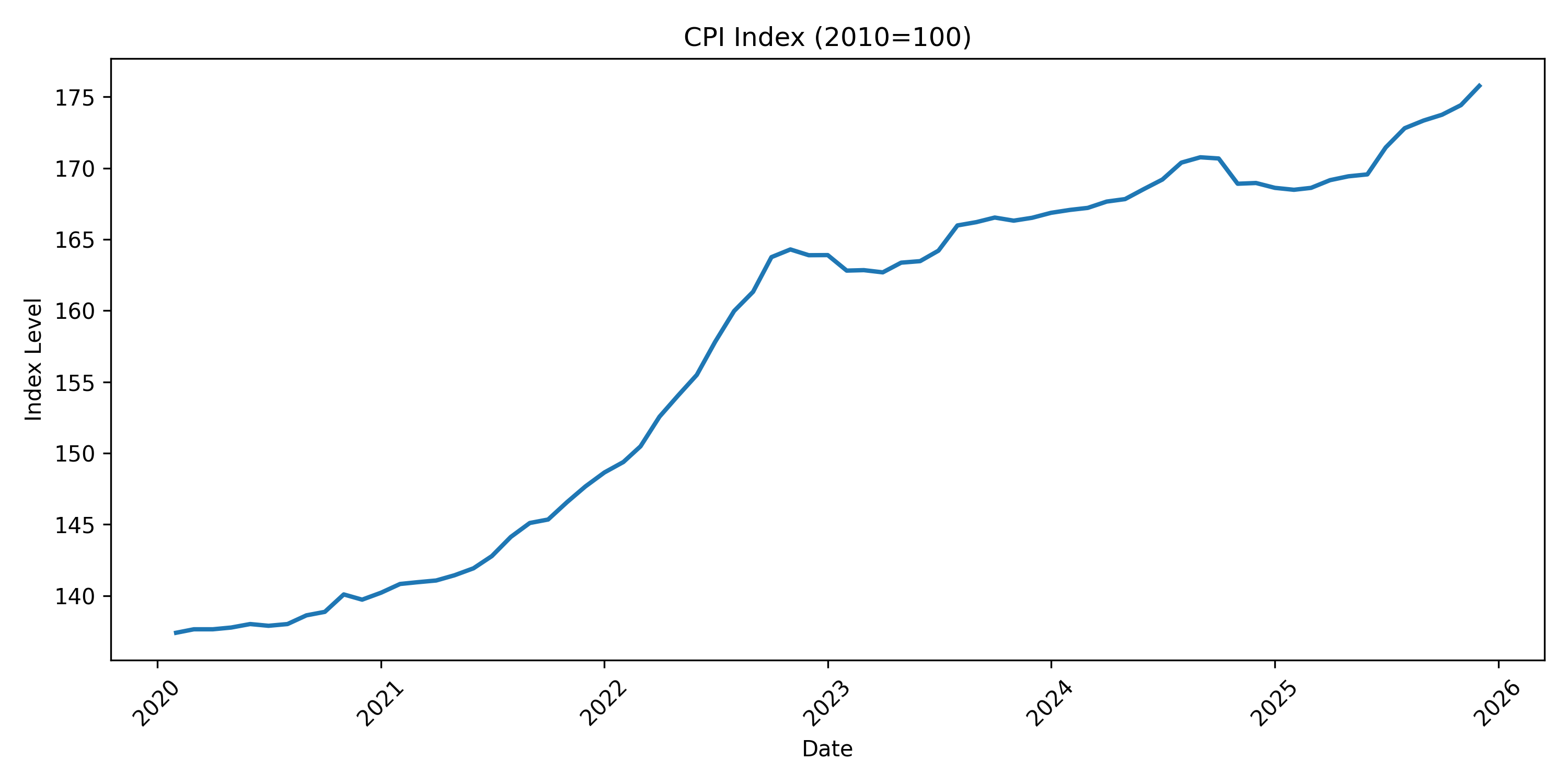

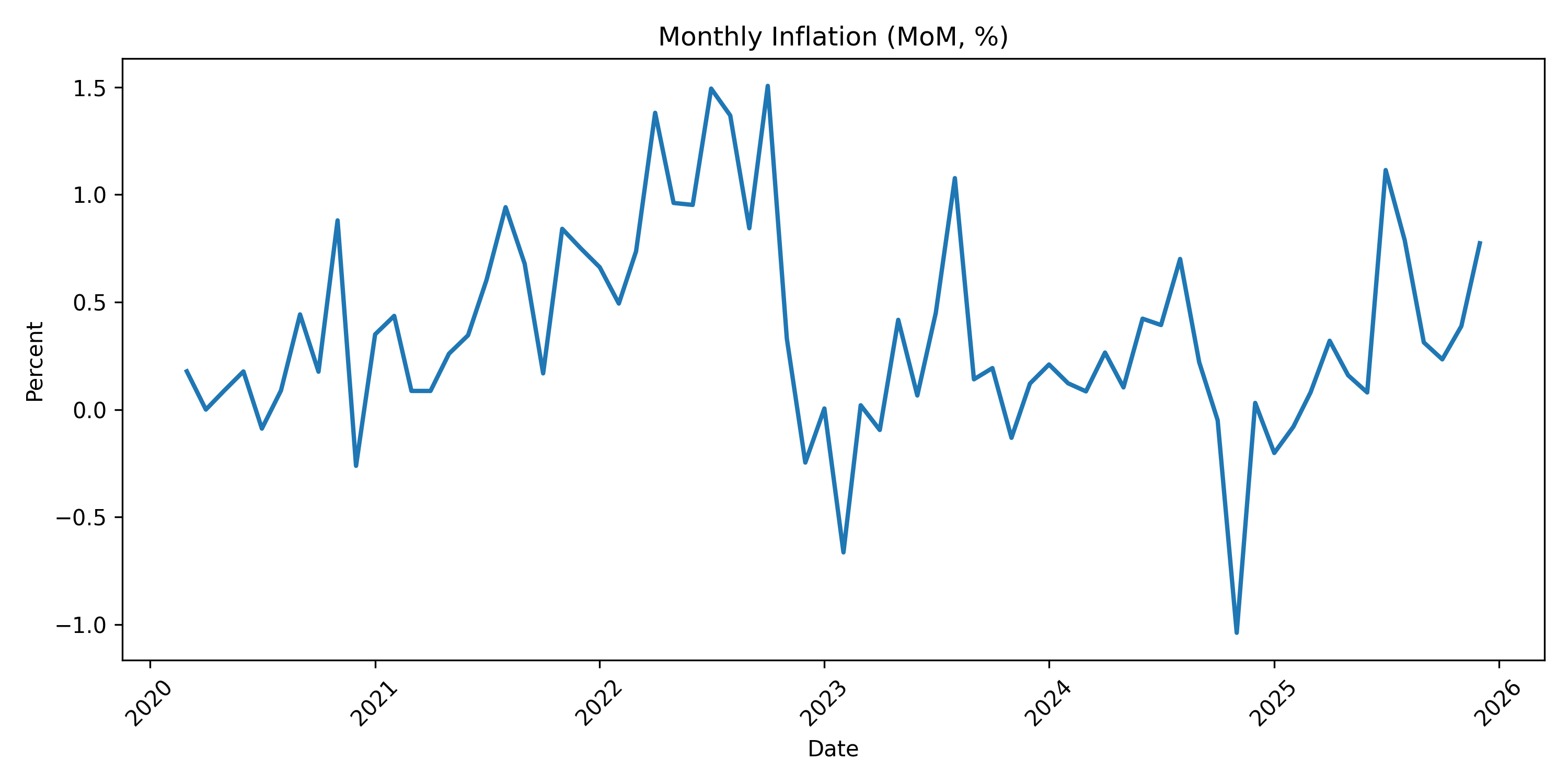

1) Level

The CPI index and its monthly and annual changes.

2) Transmission (β)

How strongly exchange rate movements appear in inflation.

Mathematically:

\[ Inflation_t = \alpha + \beta \cdot FX_{t-k} + \varepsilon_t \]

If β is large → inflation amplifies currency moves.

If β shrinks → inflation becomes insulated.

3) Memory (ρ)

Does inflation persist month to month?

\[ Inflation_t = \rho \cdot Inflation_{t-1} + u_t \]

If ρ is high → inflation carries inertia.

If ρ falls → the system forgets shocks faster.

This is not theoretical. We estimate both.

The Baseline Data

CPI Index (2010 = 100)

Monthly Inflation (MoM, %)

USD/MRU Monthly Change (MoM, %)

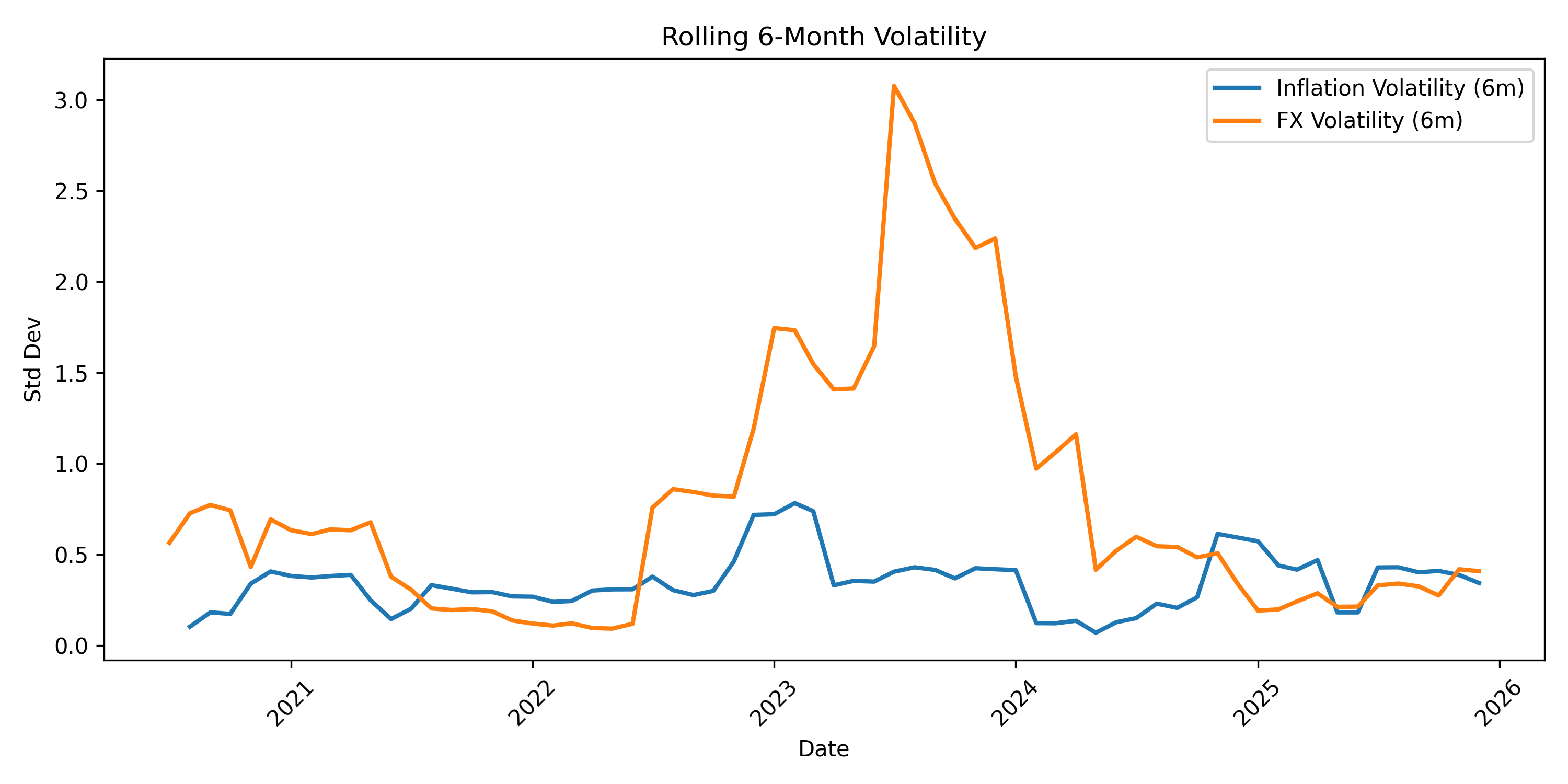

Volatility Comparison (6-Month Rolling)

What This Site Will Demonstrate

- 2022 was an amplifier regime.

- 2024–2025 shows characteristics of a shock-absorbing regime.

- Transmission strength (β) declines.

- Inflation memory (ρ) declines.

- Volatility no longer cascades forward.

The result is not cosmetic.

It is structural.

Why This Matters

If inflation amplifies shocks, the economy is fragile.

If inflation forgets shocks, the economy stabilizes.

The difference is not rhetoric. It is measurable.

And it changes how policy should be designed in the gas-export era.

This report is entirely data-driven.

All charts are reproducible.

All transformations are documented.

All equations are explained in plain language.

No speculation.

No abstraction.

Only measured behavior.

Bechar Agatt

Explore the Analysis

This report examines whether Mauritania’s inflation mechanism underwent a structural transformation between 2020 and 2025.

→ The Great Decoupling — The core thesis: from amplifier to shock absorber